New Markets Tax Credits

How the New Markets Tax Credit Program Works

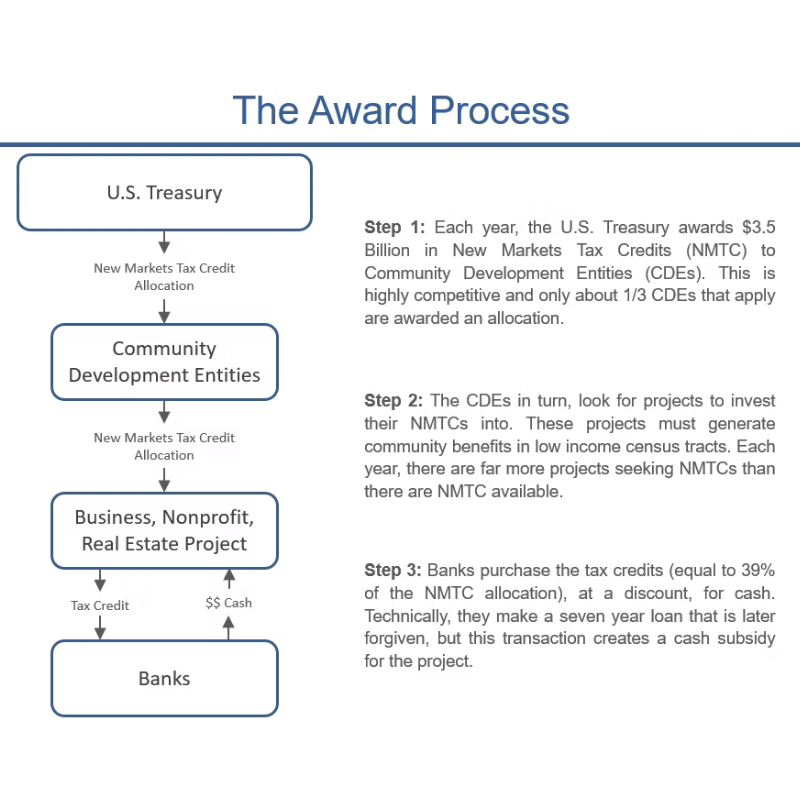

Each year, the U.S. Treasury, through the Community Development Financial Institutions Fund (CDFI), issues New Markets Tax Credits (NMTCs) to Community Development Entities (CDEs). These entities are responsible for distributing these tax credits into high-impact projects across the country. With over 200 CDEs in the U.S., each one submits applications annually to the CDFI for a limited allocation of NMTCs. The process is highly competitive, with only one out of every three CDEs successfully receiving an allocation in any given year.

Because of this intense competition, CDEs have become very selective about the types of projects they choose to fund. They focus on projects that align with their specific investment goals, whether that’s improving underserved rural communities, investing in healthcare and social services, or supporting the cleanup of contaminated sites, such as brownfields. These targeted efforts ensure that CDEs stand out in the competitive landscape and increase their chances of being awarded an allocation of New Markets Tax Credits.

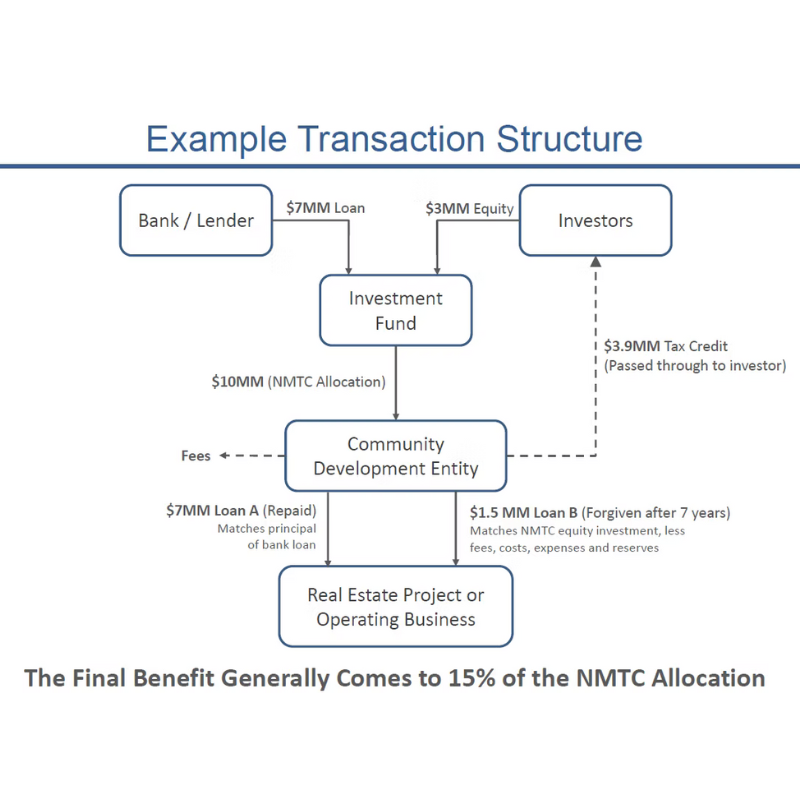

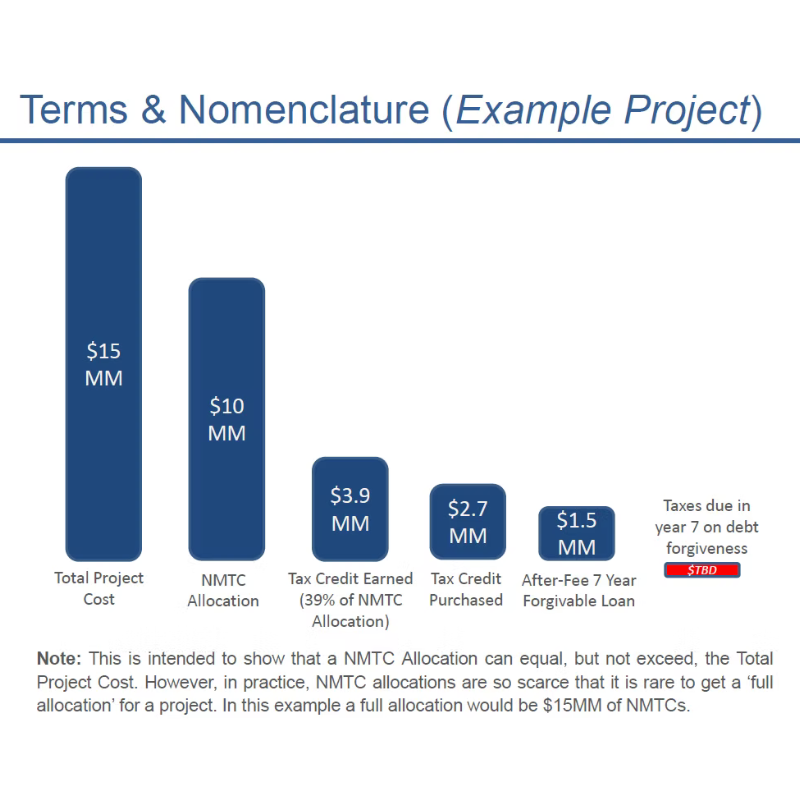

Once a CDE receives its allocation of New Markets Tax Credits, they allocate those credits to projects that meet their specific criteria and that they believe will create the most significant social and economic impact in the community. In turn, the recipients of these credits—whether they are real estate developers, business owners, or non-profits—can sell the tax credits to investors. This sale generates a cash subsidy, which is then used to fund the development, ultimately lowering the project’s overall financing costs.

We Fund Projects with New Markets Tax Credits

Pharmaceutical

Manufacturing

Plastic-To-Oil

Recycling Facility

Mixed Use

Development

Campus Health

Professions Hub

Silicon Foundry

Refurbishment

Corporate

Headquarters

Corporate

Headquarters

Steel Galvanizing

Plant Financing

Extruded Pipe

Plant Financing

Food Processing

Plant Financing

What Is the New Markets Tax Credit Program?

Each year, the U.S. Treasury awards New Markets Tax Credits to Community Development Entities (CDEs)—organizations dedicated to investing in high-impact projects. CDEs then allocate these tax credits to eligible developments, allowing them to raise equity from investors in exchange for tax benefits.

The result? A powerful financing tool that reduces costs, supports economic revitalization, and makes projects more financially viable.

How to Obtain New Markets Tax Credits for Your Project

As a potential recipient of New Markets Tax Credits (NMTCs), your goal is to make your project align as closely as possible with the annual CDFI application, and to identify which Community Development Entities (CDEs) are the best fit for your project. It’s even better if you can get your project included in a CDE’s application to the CDFI and actively market your project to the CDE community throughout the year.

To be considered for NMTC financing, your project must:

- Be located in a qualified distressed census tract

- Have a budget of at least $5 million — though $10 million or more is ideal

- Provide a clear benefit to the low-income community — through job creation, social services, affordable housing, or other accessible benefits

Have all other financing identified (NMTCs are last-money-in) and ensure compliance with NMTC program requirements

Priority is given to projects in underserved areas like rural communities or underserved states. Additional priority goes to projects that align with national priorities. For example, when the opioid crisis gained attention, healthcare centers serving affected populations were favored.

Similarly, when Opportunity Zones emerged, projects in those areas received increased support. Lastly, CDEs often face pressure to deploy capital quickly. If your project has all financing secured, approvals in place, and is ready to close, it stands a strong chance of receiving an allocation ahead of delayed projects.